What are The Benefits of Creating an Insurance Chatbot?

By Abhinav Girdhar | Last Updated on July 23rd, 2024 11:31 am | 4-min read

Insurance chatbots are taking the insurance industry by storm. Making small investments in an insurance policy can enhance financial security and provide people with a safety net in their life. An insurance policy can help people to be prepared for the unexpected. Also, for many people getting an insurance policy is a smart investment plan.

Table of Contents

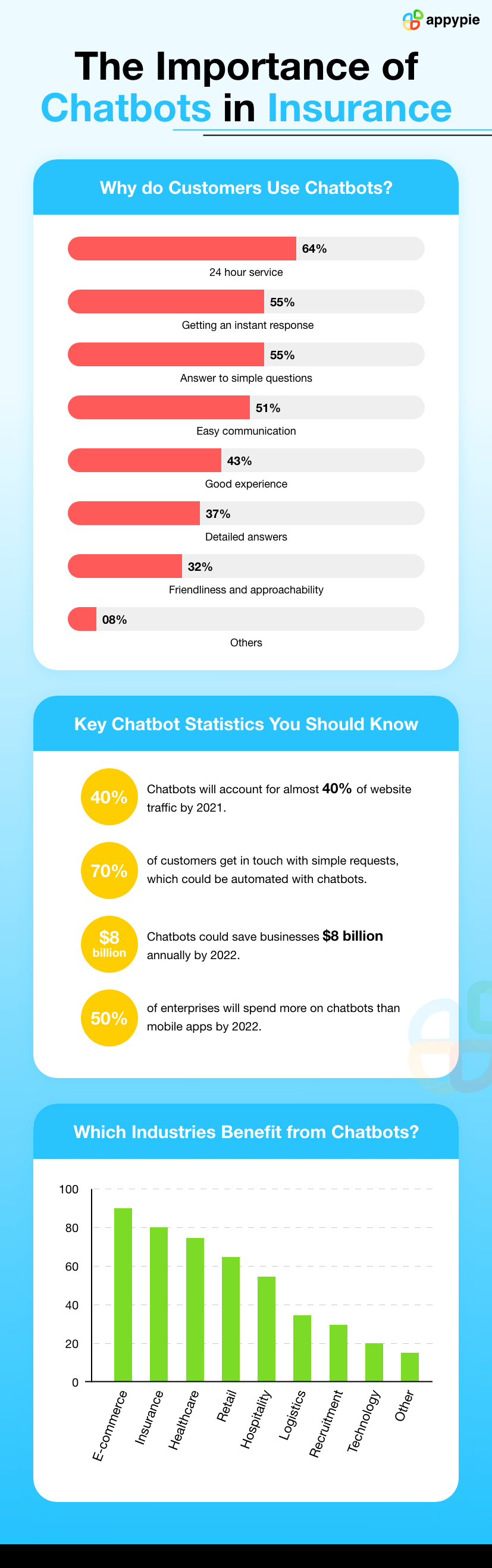

Just like every other industry, the insurance industry has seen a disruption. Thanks to the advancements in technology! With technological advancements and the major paradigm shift towards smartphones, the insurance industry has faced many challenges including the need of improving customer support. However, there has been a technological breakthrough that can help insurance firms around the world to improve their customer experience. That is an Insurance chatbot! Chatbots in insurance are a rising trend as they help insurance firms to make customer experience seamless. In this blog, we’re going to understand the benefits a chatbot brings to the insurance industry. Here are some statistics that may help you understand why the insurance industry needs chatbots.

Due to the various challenges that insurance industry faces, adding chatbots for customer support has become a viable option for insurance firms

Due to the various challenges that insurance industry faces, adding chatbots for customer support has become a viable option for insurance firms Challenges Faced by the Insurance Industry

The modern-day insurance industry faces many challenges. Both technology and customer expectations are leaving them behind. Let us try and understand why the insurance industry faces this challenge. Here is a list of challenges faced by the insurance industry:- Customers Don’t Trust Insurers

- Customers Don’t Understand Their Policies

- Complicated Claims and Renewals

- Customer preference

Insurance is one of the least trusted industries on the planet. Thanks to ill practices of insurers in the past customer perception for the insurance industry is generally negative. People are hesitant to put their money in insurance due to a lack of knowledge of hidden clauses in the policy and the fear of losing all the invested money.

On the other end, insurance companies that are open about their policies are often seen as shady. A chatbot can help build trust by communicating with customers, provide them with all the relevant details, and providing quick solutions to build a rapport between customers and the insurance company.

People lack proper knowledge about how beneficial and helpful insurance policies can be. An insurance policy is often a complicated legal document. It is difficult to understand the complex legal terms that are often defined under various clauses. Integrating a chatbot feature into your insurance business plan can not only enhance customer experience but also streamline the process of policy understanding and acquisition, ultimately boosting customer satisfaction and retention.

Claiming insurance and its renewal is unnecessarily complicated. There is a lot of paperwork involved to claim your insurance. However, with the help of a mobile app and chatbot, insurance claims can be made easier for customers. In fact, it is possible to automate the claims and renewal processes with the help of a chatbot. You can simplify the claims process to the point where all a customer needs to do is enter their name, email, and phone number to claim their insurance.

Not many customers feel comfortable while talking to an individual over phone or email. Interacting over chat messaging has become common practice. Almost 45% of customers find it better to resolve their issues through a chatbot. Getting on the bandwagon before it’s too late is just good business sense.What are the Benefits of Insurance Chatbots?

Chatbots are a well-known medium for lead generation and marketing a brand. They engage with customers directly and bring numerous benefits. Here are a few benefits of adding chatbots to your insurance firm:- Generates Leads

- Provide customer support

- Guide Customers through Your Insurance Plans

- Help Get Claims & Renewals

- 24*7 service

- Cost-Effective

Lead generation chatbots can engage with potential customers on your website and turn them into leads by collecting customer information. A lead generation bot can answer user questions, suggest policies and ask customers for the contact information in a friendly manner.

Chatbots are excellent tools for customer support. Chatbots help answer various customer queries. Since insurance policies are backed by a certain set of rules and regulations, a chatbot can help your customers understand their policies . It can help them understand some of the clauses mentioned in their policies. Other than that, a chatbot can help connect users to relevant support agents, answer their inquiries and provide the latest information about their policies. For example, if a user wants to know how much money their insurance will cover, they can ask your website’s chatbot and get a response instantly.

Insurance firms have tons of policy plans to match every type of customer’s needs. Having a chatbot dedicated to help users in understanding each plan and what suits them best is a great way to guide your customers.. It also helps build trust for your brand.

A good chatbot can simplify the claims and renewals process by turning the complex processes that are usually involved and automating them. When you implement a chatbot, all the user has to do is enter his information and his claim can be passed through immediately.

Emergency can knock on your door anytime. A chatbot can assure 24*7 availability for customer assistance. Unlike human support agents, a chatbot doesn’t need to rest or recuperate.

Chatbots are extremely affordable for the long run. They can consistently provide a high ROI with less maintenance costs.How to Create an Insurance Chatbot

Chatbot technology has come a long way. Presently, creating a chatbot has become easier than ever. You can create a chatbot without coding with Appy Pie Chatbot. We have a detailed guide on how to make a chatbot from scratch with Appy Pie Chatbot. Appy Pie provides you a chatbot builder that is easy-to-use . Simply choose a design for your chatbot, create an interactive bot flow and deploy your chatbot on your website pages. You can use Appy Pie to make bots for lead generation, customer support, and chatbot marketing. Create an insurance bot with Appy Pie Chatbot today!Conclusion

Chatbots are necessary for a modern business. With chatbot builders like Appy Pie Chatbot, it is possible to create a chatbot with almost no effort. Just a little bit of creativity and a few clicks are all you need. Adding these chatbots to your industry firm can assist your customers and potential clients . It can help build customer trust and brand reputation without too much fuss.Leave us a comment below and subscribe to our newsletter for exciting blogs related to chatbots!Related Articles

- Cross-Selling and Upselling- The Dual Paths to Increasing E-commerce Sales

- Spectrum of Yellow Background Shades: From Lemon Zest to Mustard

- 11 Best Trello Integrations to Use in 2021

- Should You Learn SwiftUI or UIKit?

- Challenges of Enterprise App Development and How to Overcome Them

- Why Student App Development Programs Are Important

- How to Create Movie Streaming Websites with Download Feature?

- What is a Choropleth Map and How To Create One

- 3D-GRAND: Towards Better Grounding and Less Hallucination for 3D-LLMs

- Elevating Consumer Care with Chatbots: Definition and 5 Real-life Examples

Most Popular Posts

- Emergence of AI-Design Tools: Transforming Creative Workflows

- How to Use Notion AI [A Complete Guide]

- Kylie Jenner is surpassing her famous sisters, Kim and Khloe Kardashian, in terms of app downloads and revenue

- 5 Best Cheap Domain Registrars Compared and Reviewed

- Baby Blue Color: Shades, Combinations, and the Hex Code Revealed