What are the Benefits of Creating a Banking Chatbot?

By Abhinav Girdhar | Last Updated on March 1st, 2024 7:54 am | 4-min read

There are various use cases of business chatbots. A lot of industries can use chatbots for their business processes. Presently, one of the industries that is eyeing chatbot technology is banking .

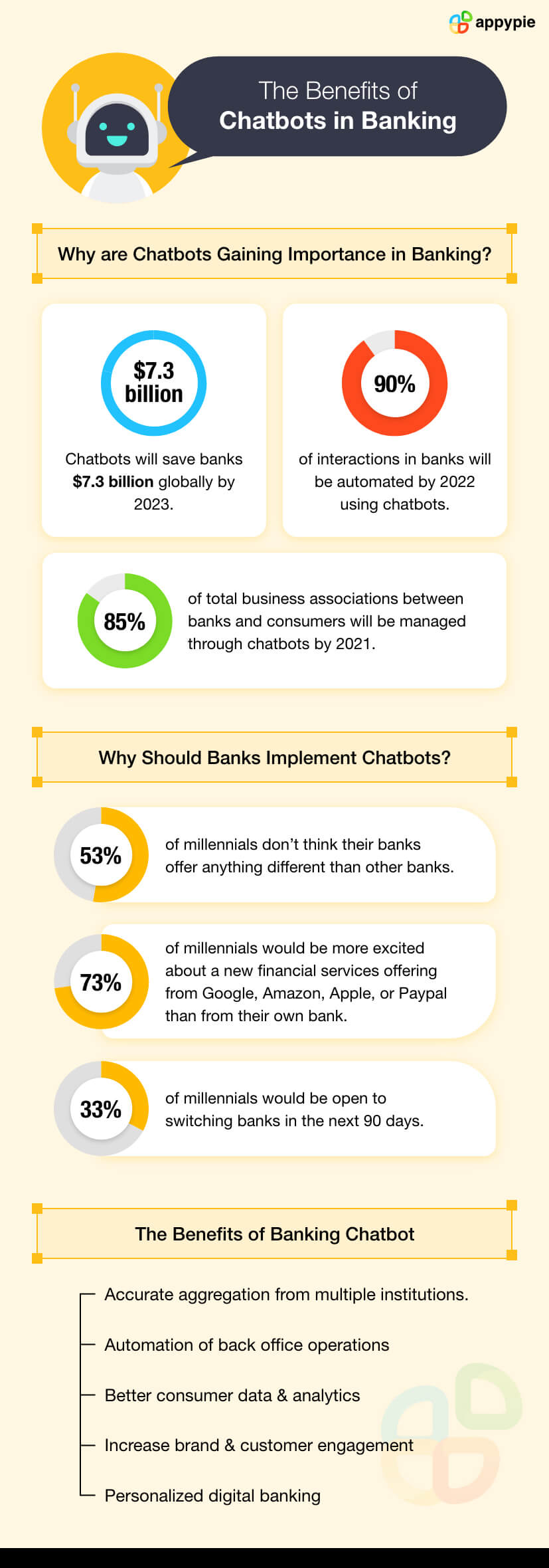

Poor service has always been a detriment for the banking industry. Many reputed banks continuously lose customers due to unexpected delays caused by banking employees being riddled with work. A good chatbot can help in easing the pressure on the banking system and thereby increasing customer satisfaction. If you're a bank that wants to improve customer experience , a chatbot may be the solution. Before we discuss the various benefits a chatbot can bring to your business, here are a few statistics related to banking chatbots. .

Banks around the world are developing and integrating banking chatbots.

Banks around the world are developing and integrating banking chatbots. Benefits of Creating Banking Chatbots

Following are the benefits chatbots bring to your banking business;- Round-the Clock Support

- Personal Banking

- Customer Feedback and Satisfaction Analysis

- Better Marketing

- Financial Guidance

- Assisting Employees

- Cost-Effective

Ever since banking became electronic, the industry’s weaknesses have come to the fore. Despite banks deploying the latest technologies, there are still a lot of shortcomings with customer support. Most banking processes are difficult to understand for the average customer.Customer support team find difficulty given the volume of customers and limited employees. This is when a chatbot can help.

Chatbots are built to make support easier for businesses. Customers that need consultation can simply be done with the help of a chatbot. The best part about the chatbot is that it can be available 24*7 giving users complete freedom to ask doubts anytime. HSBC bank has deployed such a support chatbot called HSBC Amy. It helps answer basic customer queries.

Customers have become more demanding over time. Most of them expect personal banking services.. Customers request everything from dealing with bank accounts, balance checking to information on recurring transactions and want results in a jiffy.

A chatbot can help ease the pressure on your banking system by automatically providing customers with personal banking services. Chatbots are bound to work because according to current trends, live chat support usually deals with personal banking. Replacing live chat with a chatbot isn’t too difficult and is cost-effective in the long run. Wells Fargo is one of the banks that offers personal banking services with the help of a facebook chatbot.

One of the reasons why banking had so many unhappy customers is lack of customer feedback facility. With a correctly integrated chatbot, you can gauge customer feedback and analyse how satisfied your customers are with your services.

You can even gauge what makes them unhappy, find shortcomings and apply new solutions to improve your services over time.

Chatbots are good marketing channels. Advertising only is no longer the best way to get and retain customers. With the help of a chatbot, you can market directly to your customers. To take it to the next level, you can personalize this marketing down to the individual customer.

People are usually bad at managing their own finances. The basics of financial management must be taught to your customers. The easiest way to teach them is through an appropriate chatbot. Either you can create lengthy user manuals to teach users or could create a conversational chatbot which will be more engaging and will teach better than a thick manual.

The usability of chatbots doesn’t end at the customer’s end. Chatbots can be created to assist in your internal processes too. There are various areas where chatbots can assist employees.

Staff training is one of the processes where chatbots can be applied. A new employee in a bank must learn how to work with complex banking systems and software some of which may be proprietary, remember various rules and regulations, and learn corporate policies and culture. A chatbot is an efficient way to teach the new staff. Chatbots can be humanized to provide an experience wherein an employee feels comfortable and learns as if learning from a colleague. A chatbot can mentor employees with quizzes, questionnaires, etc at regular intervals and keep track of what they’ve learned.

Banks need to be up-to-date with the technical aspects. Since banks hold crucial information, they usually follow strict protection norms, protocols and passwords. A consulting chatbot might assist with the technicalities of various software and educate employees . Another application of chatbots for internal processes involves - HR departments. OCBC, a Singapore based bank uses an HR chatbot called buddy to answer questions based on employee profiles.

Last but not least, banking chatbots are extremely cost-effective in the long run. Once made, the chatbot can be deployed on any page(website & app) any time you want. Compared to other forms of customer support, chatbots can provide more return for your investment. The fact that they are essentially free once creates an even more lucrative choice for banks.How to Make a Banking Chatbot

Thanks to the advancement in chatbot technology, creating a chatbot is very simple. With Appy Pie’s Chatbot, you can create a fully functioning customer support chatbot without any coding. We have a detailed guide on how to build a chatbot from scratch with Appy Pie Chatbot. The guide will help you create your new banking chatbot.Conclusion

Chatbots for banking will keep rising in importance as banking gets more and more complicated with time. Get on the bandwagon today and build a support chatbot for your bank.Leave a comment and tell us how your banking chatbot works. Also subscribe to our newsletter to receive the latest news from Appy Pie’s Blog!Related Articles

- Pastel Yellow Color: A Comprehensive Exploration of Hues and Significance

- Top Reasons Why iOS is All Set to Be the Future of Mobile App Development

- The Power of ServiceNow Integrations

- How To: Market Research for Your App Idea

- Unlock the Secrets of ACV and ARR- Propel Your Business Forward with Smart Strategies

- UMBRAE: Unified Multimodal Decoding of Brain Signals

- NFTs, The Cryptocurrency of 2022

- 6 Points to Remember Before You Hire the Right Talent in 2021

- How to add a signature in Outlook? [Top Outlook Integrations with Appy Pie Connect]

- 10 Best Todoist Integrations That Will Boost Your Productivity