What is Schedule C (Form 1040) & how to file it?

If you are a freelancer, a sole owner of a business, or operate as an independent contractor, you will need to file IRS Schedule C to report income or loss from your business activities.

IRS Schedule C is a tax form that needs to be filled in by anyone who owns and operates a business as a sole proprietor or a single-member limited liability company (LLC). The IRS Schedule C form is one of the most common business income tax forms for small business owners. Schedule C Tax Form shows the income of a business for the tax year, as well as deductible expenses. A Schedule C (Form 1040) is used to report profit or loss from a business you operate or a profession you practiced as a sole proprietor.

Who needs to file Schedule C?

Schedule C is for sole proprietors - people who freelance, have a side business, are independent contractors or operate a business on their own.

Also, single-member limited liability corporations are required to fill Schedule C forms. A single-member LLC is a business entity owned by just one person.

Single-member LLCs that choose not to be treated as a corporation also need to use Schedule C because they are considered as disregarded entities by IRS.

Apart from this, someone who is a full time job holder and a freelancer on the side also needs to fill the Schedule C form.

For tax purposes, as per IRS you are in a business if you are pursuing your work continually and regularly, which means you need to fill the Schedule C form.

What information do you need to complete Schedule C Tax form?

You will need the following information to complete your Schedule C Tax form:A profit or loss statement or an income statement for the tax year.

A balance sheet for the tax year.

Statements related to purchase of assets during the tax year, including vehicles, equipment, and property.

Information on inventory to prepare the cost of goods sold.

Details on travel and car/truck expenses, meals and entertainment expenses, and home business expenses.

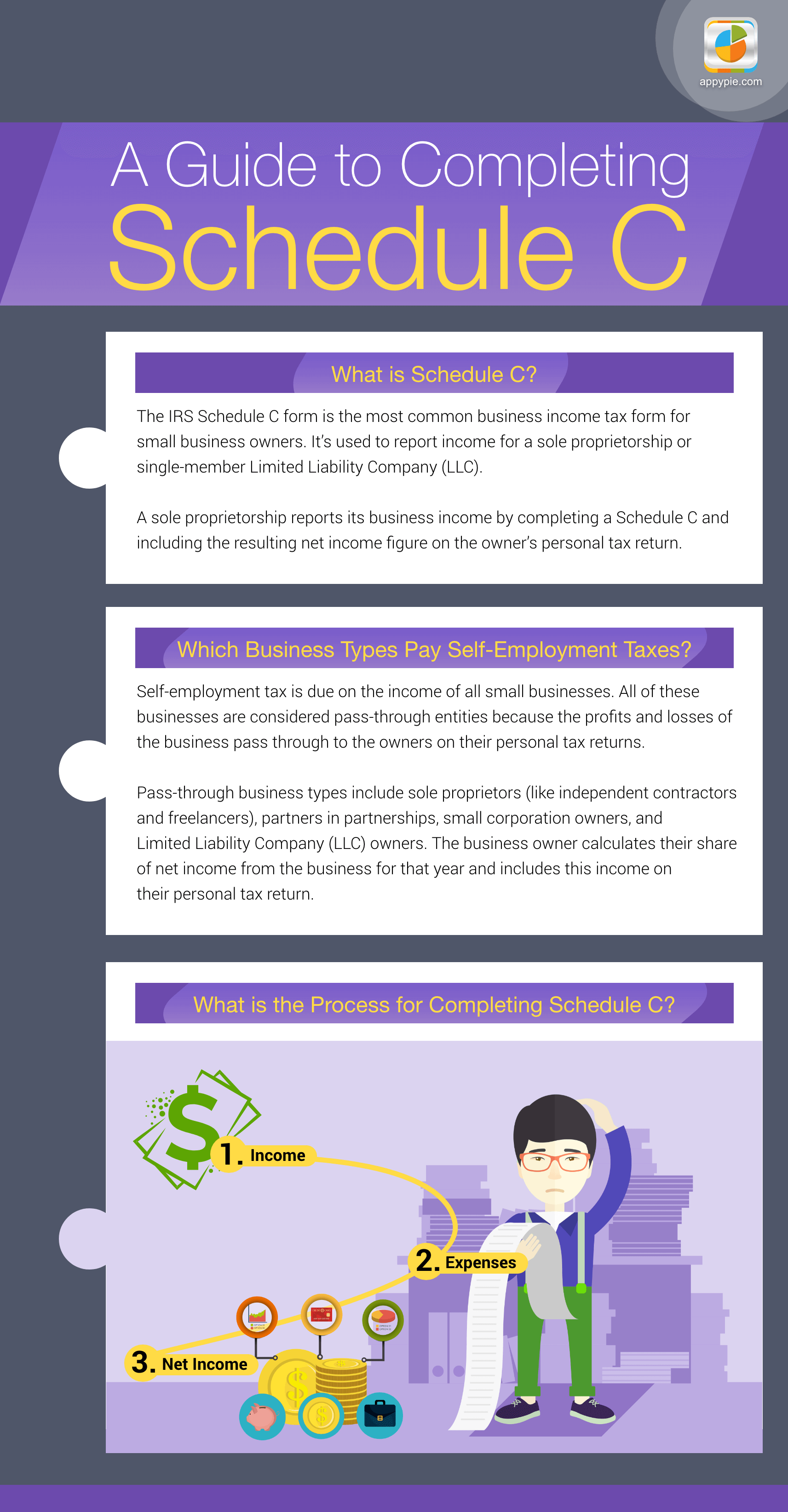

What is the process for completing the Schedule C Form?

To complete Schedule C, follow the steps mentioned below:- Income

- Expenses

- Net Income

If you sell products and have an inventory, you will need to complete the Cost of Goods Sold Section (Section III of the form) to calculate the cost of products. After that include all income, and subtract returns and allowances and cost of goods sold to get the Gross Income.

(In Section II) include all of your deductions for business expenses. If you have a vehicle that you drive for business calculate this deduction. If you use a part of your home for business, you will have to use IRS Form 8829 for the calculation of this deduction, or you may be able to use a simplified calculation.

The final part of Schedule C calculates net income by subtracting deductions from Gross Income. Schedule C Tax Form is not very simple so we have listed the information for you. You can find the form here. You can find complete details on how to complete Schedule C instructions in a step-by-step process explained below:

- Gather Information to Complete Schedule C

- Calculate Business Income

- Include Your Business Expenses

- Wages and Other Payroll Expenses

- Vehicle Expenses

- Other Expenses

- Calculate Your Net Income

You must identify the principal profession your business engages in, and the name and address of your business. You will need an Employer ID number of your business. You'll also need your business income and expenses for the year. It includes expenses from all sources related to the business.

To calculate the business income - you first need to include gross receipts, then include returns and allowances, then subtract the cost of goods sold, and you will have your Gross Profit. Add other incomes like the interest income, to get your total Gross Income. You will need your beginning inventory, what additional goods were purchased or produced, inventory that was sold, and your ending inventory. You can ask for help from a tax adviser. You can calculate your gross profit as follows:GROSS RECEIPTS FROM SALES - RETURNS AND ALLOWANCES = NET RECEIPTS NET RECEIPTS - COST OF GOODS SOLD = GROSS PROFIT GROSS PROFIT + OTHER INCOME FROM TAX CREDITS OR OTHER SOURCES = GROSS INCOME

Business expenses that you can deduct are listed alphabetically in Schedule C Income Form. This includes advertising, vehicle expenses, fees paid to agents, commissions, and contract labor, which includes contractors.

You can deduct depletion, depreciation, Section 179 expenses, employee benefits and insurance. Interest on mortgages and other business debts, legal and professional fees, office expenses, pension and, profit-sharing plans are also deductible. You even need to deduct costs associated with the rental or lease of vehicles or other business equipment.

Other expenses like bank fees, uniforms, and clothing, dues for clubs and organizations, internet and website charges, books, magazines, and software are also deductible.

Other deductibles include:

The final calculation is done for net income. Enter the total expenses and subtract this amount from your tentative profit. After that subtract the expenses for the business use of your home to get your net profit or loss. This is the number that you should report on your income tax return, Form 1040.Points to remember

The following points are to be considered while filing a Schedule C FormYou must file a separate Schedule C for each business you own, showing the income and deductions from income for that particular business.

While filing schedule C two people are considered partners and must file a partnership tax return when they own a business together. However, if you and your spouse both actively participate in the day-to-day operations of your business, you both should file separate 1040 Schedule C forms and divide the business income and expenses between you. This type of business is called a qualified joint venture.

Most small businesses must use Schedule C to calculate their business taxes. Schedule C lists the business income and expenses and calculates the net income of your business.

However, some small companies may be able to use Schedule C-EZ instead. Schedule C-EZ lists only the primary information about the business and includes only a simple calculation of business profit (net income).

Why do some Businesses use Schedule C-EZ instead?

Many sole proprietors can use a simpler version called Schedule C-EZ. This form omits a lot of the detail in the full form 1040 Schedule C and just asks for your total business receipts and expenses. However, you still need to complete a separate section if you claim expenses for a vehicle. You can use Schedule C-EZ only if you operate as a sole proprietorship and do not report more than USD 5,000 in business expenses. You can also use Schedule C-EZ if you are reporting a net profit, don't hold business inventory during the year, have no employees and are not claiming a deduction for a home-office.Conclusion

Experienced entrepreneurs may find the IRS Schedule C intimidating, and new business owners might be unsure on the form they need to use. IRS instructions for business income Schedule C have an in-depth explanation to help you understand what needs to be done. However, it is always best to get a tax professional to help you fill the forms. If you are looking forward to building your own Form App then Appy Pie's Form Builder will help you.Related Articles

- 15 Pro Tips to Master Calendar Management for Optimizing Your Time

- How to Design a Restaurant Menu? (Step-by-Step Guide)

- 10 Best Employee Scheduling Software in 2024

- Purple Color: Significance, Symbolism, and Shades

- Benchmarking Large Neighborhood Search for Multi-Agent Path Finding

- Knowledge Management: Definition, Types, and Benefits

- Top 28 eCommerce Website Templates

- Alpha Invariance: On Inverse Scaling Between Distance and Volume Density in Neural Radiance Fields

- 10 Foolproof Ways to Promote a Website For Free

- Why Should Teachers Use Evernote For Education?