What is Bankruptcy? – Steps to File for Bankruptcy

By Abhinav Girdhar | Last Updated on May 25th, 2024 8:43 am | 6-min read

Table of Content

In the blog further, we will talk about bankruptcy, its types, and the steps to file for bankruptcy.

In the blog further, we will talk about bankruptcy, its types, and the steps to file for bankruptcy. What is Bankruptcy?

Bankruptcy is a centralized legal process meant to help individuals and companies get a financial fresh start by removing or planning to pay off their unmanageable debt. It can also be a tactic for companies to liquidate their assets in an orderly way when they want to wrap up their business. The anticipated outcome of most bankruptcy cases filed by businesses or individuals is a discharge. A discharge is an order from the insolvency court permanently forbidding any creditor from trying to collect a debt against you. This process is also called ‘Bankruptcy Injunction’.(Above video is a part of a more elaborate course on Academy by Appy Pie. To access the complete course, please Click Here, or continue reading below.) However, some debts cannot be discharged such as child support, tax debts, and spousal support. Bankruptcy laws help people dealing with financial fall and give them a chance to start over.Who files for Bankruptcy?

When businesses or individuals have far more debts than they can pay back, and do not see that changing anytime soon, they file for bankruptcy. The most surprising fact is that it is individuals, not businesses who often seek help this way. For example, people who have taken on financial obligations like an auto loan, a mortgage, a student loan, and in some cases all three but don’t have the money to pay them back. As per the record, among 844,495 bankruptcy cases filed in 2015, only 24,375 were filed by businesses and 97% of them (819,760) were filed by individuals. Also, most of the individuals filing bankruptcy were not specifically wealthy. The report also stated that the average income for the whole 97% of individuals was just $34,392 with the expenses of $30,972. There is no doubt that bankruptcy is a chance to start over, but it affects your future financial abilities. It may delay or prevent foreclosure on a home and repossession of a car. It can also stop wage garnishment and other actions creditors use to increase debts. However, in the end, there is a price to pay.When should you file for Bankruptcy?

This is not the correct question to be asked as there is no ‘perfect’ time to file for bankruptcy. Instead, the question you should ask is - Should I file for bankruptcy? If your balance sheet indicates that it will take more than five years for you to pay off all your bills and debts, it is a sign that you should file for bankruptcy. Bankruptcy code has been set up to give people another chance to start again and not to punish them. If you do not qualify for bankruptcy even if the combination of business credit cards debt, small business loans, mortgage debt, student loans, business debt, and medical bills has devastated you financially, there is still hope.(Above video is a part of a more elaborate course on Academy by Appy Pie. To access the complete course, please Click Here, or continue reading below.) There are various other debt-relief choices including a debt settlement or debt management program. However, both these programs usually need 3-5 years to get you a resolution and neither one ensures that all your debts will be settled when you finish. The bankruptcy process carries substantial long-term penalties and remains on your credit report for 7-10 years, but it also gives you a great mental and emotional lift allowing you a fresh start after getting all your debts eliminated.Steps to File for Bankruptcy

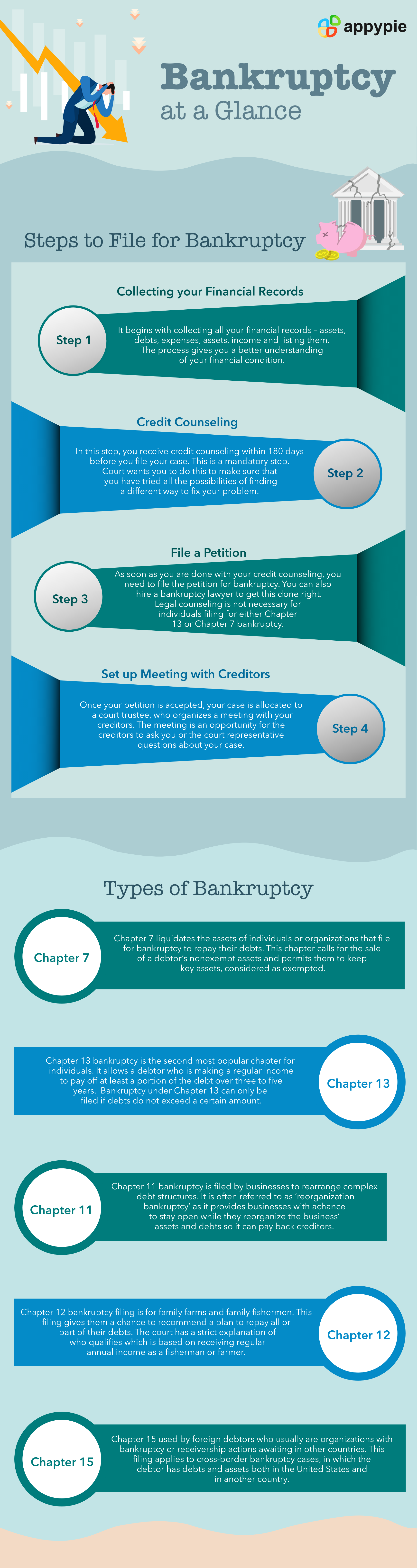

Filing bankruptcy is more than simply telling the court ‘I’m broke!’ and throwing yourself at their mercy. This is at times a complicated and confusing process that businesses and individuals must wade through.Step 1 – Collecting your Financial Records

It begins with collecting all your financial records – assets, debts, expenses, assets, income and listing them. The process gives you a better understanding of your financial condition.Step 2 – Credit Counseling

In the next step, you receive credit counseling within 180 days before you file your case. This is a mandatory step. You must get this counseling done from an approved provider listed on the United States Courts website. Many counseling agencies in the US offer this service online or over the phone. Court wants you to do this to make sure that you have tried all the possibilities of finding a different way to fix your problem. You get a certificate of completion from the credit counselor. This certificate must be a part of the paperwork you do at the time of filing bankruptcy or the filing will be rejected.Step 3 – File a Petition

As soon as you are done with your credit counseling, you need to file the petition for bankruptcy. You can also hire a bankruptcy lawyer to get this done right. Legal counseling is not necessary for individuals filing for either Chapter 13 or Chapter 7 bankruptcy. However, you might take a serious risk if you decide to represent yourself.Step 4 – Set up Meeting with Creditors

Once your petition is accepted, your case is allocated to a court trustee, who organizes a meeting with your creditors. You must be present at the meeting, but it is not necessary for the creditors to be there. The meeting is an opportunity for the creditors to ask you or the court representative questions about your case.Types of Bankruptcy (United States)

There are various types of bankruptcy in the United States in which Chapter 7 and 13 are the major ones.Most Filed Bankruptcy Types

Chapter 7 liquidates the assets of individuals or organizations that file for bankruptcy to repay their debts. This chapter calls for the sale of a debtor's non-exempted assets and permits them to keep key assets, considered as exempted. Examples of exempted property-- Your home

- Equipment you use at work

- A car you use for work

- Pensions

- Social Security Checks

- Welfare and Retirement Savings

- Veteran’s benefits

- Cash

- Bank accounts

- Stock Investments

- Coin or Stamp Collectionsv

- Second Car or Second Home

Other Types of Bankruptcy

Chapter 11 bankruptcy is filed by businesses to rearrange complex debt structures. It is often referred to as ‘reorganization bankruptcy’ as it provides businesses with a chance to stay open while they reorganize the business’ assets and debts so it can pay back creditors. Bankruptcy under chapter 11 is used mainly by large corporations. Some examples of organizations who filed under this chapter include Circuit City, General Motors, and United Airlines. It can also be used by any business including partnerships and individuals in some rare cases. In this chapter, business continues to function during bankruptcy proceedings, but many decisions are made with the court permissions. Chapter 9 is used by municipalities, towns, and other political subdivisions like hospital, utility, schools, or airport. It defends municipalities from creditors while they develop a plan for handling their debts. This usually happens when organizations close, and individuals leave to find work elsewhere.

There were twenty Chapter 9 bankruptcy filings in 2012, the most since 1980. Detroit was the largest city to file Chapter 9 filings in 2012. Its GDP shrunk by 12.2% in 10 years before declaring bankruptcy. The average major metro growth of the city in that time was 13.1%. Chapter-12 bankruptcy filing is for family farms and family fishermen. This filing gives them a chance to recommend a plan to repay all or part of their debts. The court has a strict explanation of who qualifies for this chapter, which is based on receiving regular annual income as a fisherman or farmer.

Debts for partnerships, individuals, or corporations filing for Chapter 12 can’t exceed $1.87 for fishermen and $4.03 million for farmers. As per Chapter 12 guidelines, the repayment plan must be completed within five years, though allowances are created for the seasonal nature of both fishing and farming.Chapter-15 is used by foreign debtors who usually are organizations with bankruptcy or receivership actions awaiting in other countries. This filing applies to cross-border bankruptcy cases, in which the debtor has debts and assets both in the United States and in another country.

The chapter was included in the bankruptcy code in 2005 as part of the (BAPCPA) Bankruptcy Abuse Prevention and Consumer Protection Act. Cases filed under Chapter 15 start as insolvency cases in other countries and make their way to the United States Courts to protect financially troubled businesses from going under. Under this chapter, the United States Courts limit their scope of power in the case to only the persons or assets that are in the United States.

Chapter 9 is used by municipalities, towns, and other political subdivisions like hospital, utility, schools, or airport. It defends municipalities from creditors while they develop a plan for handling their debts. This usually happens when organizations close, and individuals leave to find work elsewhere.

There were twenty Chapter 9 bankruptcy filings in 2012, the most since 1980. Detroit was the largest city to file Chapter 9 filings in 2012. Its GDP shrunk by 12.2% in 10 years before declaring bankruptcy. The average major metro growth of the city in that time was 13.1%. Chapter-12 bankruptcy filing is for family farms and family fishermen. This filing gives them a chance to recommend a plan to repay all or part of their debts. The court has a strict explanation of who qualifies for this chapter, which is based on receiving regular annual income as a fisherman or farmer.

Debts for partnerships, individuals, or corporations filing for Chapter 12 can’t exceed $1.87 for fishermen and $4.03 million for farmers. As per Chapter 12 guidelines, the repayment plan must be completed within five years, though allowances are created for the seasonal nature of both fishing and farming.Chapter-15 is used by foreign debtors who usually are organizations with bankruptcy or receivership actions awaiting in other countries. This filing applies to cross-border bankruptcy cases, in which the debtor has debts and assets both in the United States and in another country.

The chapter was included in the bankruptcy code in 2005 as part of the (BAPCPA) Bankruptcy Abuse Prevention and Consumer Protection Act. Cases filed under Chapter 15 start as insolvency cases in other countries and make their way to the United States Courts to protect financially troubled businesses from going under. Under this chapter, the United States Courts limit their scope of power in the case to only the persons or assets that are in the United States.How to avoid Bankruptcy?

You can avoid bankruptcy by selling some of your assets to pay off your debts. You can also seek help from your creditors. Ask them to help you avoid bankruptcy. Let them know that you are going through some financial crisis. They would rather take some money than no money at all.Try to avoid taking loans if your financial condition doesn’t allow you to.(Above video is a part of a more elaborate course on Academy by Appy Pie. To access the complete course, please Click Here, or continue reading below.)These loans include commercial loans, microloans, start-up loans, small business loans, and many others.(Above video is a part of a more elaborate course on Academy by Appy Pie. To access the complete course, please Click Here, or continue reading below.)Avoid taking small business credits. They turn into big liabilities when you do not pay them for a long time.(Above video is a part of a more elaborate course on Academy by Appy Pie. To access the complete course, please Click Here, or continue reading below.) Go through your books occasionally to know the exact condition of your business and finances. It helps you balance financial accounting, small business accounting, and basic accounting. These books include Major Cash Book, Petty Cash Book, Balance Sheet, basic business finance files, etc.(Above video is a part of a more elaborate course on Academy by Appy Pie. To access the complete course, please Click Here, or continue reading below.)Conclusion

Bankruptcy has its own pros and cons. Most people think about bankruptcy only after they pursue debt settlement or debt consolidation. Both these options can help you get your business back on track and will not negatively affect your credit score as much as the bankruptcy. However, bankruptcy assures that you get a fresh start which no other debt management plan does. Go through Appy Pie’s Academy Course and get to know more about your business finance basics and bankruptcy!Related Articles

- Secondary Colors: A Complete Guide

- How to build an AWS chatbot with AWS Lex?

- 20 Best Google Sheets Add-Ons in 2024

- A Beginner’s Guide to Google My Business

- 10 Best Mailchimp Alternatives in 2024

- WooCommerce Integrations: Everything You Need to Know

- Blue Background: Significance of Using Blue Wallpapers & Background Images

- Top 11 Best Image Color Picker Tools in 2023

- Create your own Education App with Appy Pie’s Education app builder

- How to Set Up an Out of Office Message in Gmail for Efficient Communication

Take a Related Course

- Start learning for free

(No credit card required)