Mobile Banking, Apps, & Artificial Intelligence (AI): Evolution of the Banking Services

App Builder Appy Pie: Banking is one of the sectors that are quickly moving with the changing tides and have been adopting technology quite readily and mobile technologies have played a big role in the whole evolution of the mobile banking sector.

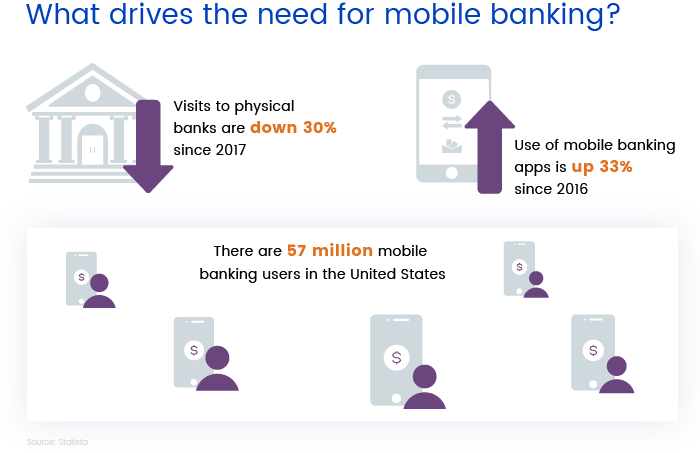

According to Statista the number of smartphone users is on a steady rise and by the end of the year 2020 the figure is predicted to stand at about 3 billion. The number of people using mobile banking apps is also increasing at the same rate.

The image below shows some of the factors that help you determine why it is important to invest in creating a mobile app for banks and other financial institution.

How Mobile Banking Apps Can Help? [7 Amazing Benefits]

- Brings down the expenses

- High ROI

- Enhanced Customer Experience

- Higher Security

- Garners Customer Analytics

- Push & In-App Notifications

- Use of Artificial Intelligence (AI)

The modern-day consumers have transitioned to mobile banking with great ease. They are aware of the myriad benefits they can enjoy with mobile banking like how convenient it is, how safe it is, and the ease of access it brings to the users.

Listed below are the top reasons why it is important that you invest in building a mobile banking app.

#1 Brings down the expenses

Mobile banking has great potential to bring down the expenses for the bank. This is majorly because mobile transactions can actually increase the overall efficiency of the bank in a big way in the following way:

- Helps the banks go paperless and become more environmentally friendly

- Saves the bank a lot of money in printing and delivery

- Eliminates the need to hire any additional workers

- Saves the bank money as mobile transactions are at least ten times cheaper than ATM transactions

- Saves the bank money on running physical branches & divisions

As per a recent research conducted by Deloitte the costs for mobile transactions are expected to come down by at least a factor of 50 as compared to branch transactions and a factor of 10 as compared to ATM transactions. By going mobile you are afforded an opportunity to reduce the costs of operation and increase overall efficiency of the bank.

#2 High ROI

There is a direct impact of mobile banking on customer engagement and returns on investment in more ways than one. The report says that when you increase the mobile banking adoption rates, an average institution can generate additional millions in revenue and bring down the attrition by up to 15 percent.

Inherently mobile banking apps are more engaging, and an engaged customer would always be using more services than someone who is not. It has been established through research that mobile banking and app customers hold more products from their banks or other financial institutions as compared to the customers who only depend on the bank branches for any interaction with the institution.

The mobile customers tend to stay for longer with the financial institutions for a longer duration and the attrition rate for the mobile banking customers is a lot lower than the attrition rate for branch-only or even online customers.

According to a recent research by ABA Banking Journal, when the users have immediate access to their financial information, they are more inclined to make additional transactions. It is for this reason primarily that the users of mobile banking services generate a higher average revenue as compared to branch only and other non-mobile banking users.

Did you know that banks generate 66% higher revenue from mobile banking service users as compared to branch-only customers?

#3 Enhanced Customer Experience

Any industry, especially industries like banking which are service oriented, depends heavily on the kind of experience the customers have while dealing with them. Let’s take a look at different ways in which having a mobile banking app can improve the whole customer experience.

Round the clock availability

With a mobile banking app the customers can complete banking transactions at their ease and convenience, irrespective of the working hours of the bank branches or the location of the ATMs. Customers have all your services in their pockets.

Immediate completion of customer needs

One of the reasons why mobile banking apps gained such popularity in such a short time was because it brought all the services to their fingertips. In this world of instant gratification, the mobile apps give customers the satisfaction that they seek, thus making them loyal to the bank or financial institution.

Personalization

This is something that even a novice is aware of and familiar with. A personalized customer experience goes a long way in helping your business grow. When it comes to financial institutions like banks, it is of critical importance to build a trust among the customers. Using mobile apps, banks can gain access to a lot of information including the user behavior and preferences. The banks can then leverage all this information and create unique experiences for the users. Doing so can increase the customer satisfaction manifold and increase the bank’s credibility as well.

Offers Complete Control to the Customers Over Their Finances

Mobile banking lets the customer assume active control, over their finances by closely monitoring their account balances and by getting periodic alerts, letting them transfer money at any time of the day instantly, depositing checks and accomplish so much more by themselves independent of the bank and the staff.

#4 Higher Security

In the current environment of internet and digital vulnerabilities, security is a big concern among the customers. It is true that both, online and mobile banking come with their own set of vulnerabilities, but extra layers of hardware security add to the security offered by mobile banking making it safer than the online version. This is especially true if you offer banking services for students like MOS does.

To make their apps secure, banks add security solutions and features like gesture patterns and biometric data including fingerprints and retina scans to fortify the existing measures like password protection and two-factor authentication. It is a standard process for any financial institution today to use encryption for the protection of sensitive financial information and to offer privacy, thus providing worry-free banking.

#5 Garnering Customer Analytics

A mobile app lets you garner and analyze actionable data, further enabling you to measure and improve your services and the experiences that you are offering to your customers. The data can then be leveraged by the banks in order to better understand the way users interact with the apps and the reasons for their in-app actions. The data points can all be categorized into three major categories – customer satisfaction & user engagement, customer acquisition, and performance.

The data points related to customer satisfaction and user engagement let the banks focus their attention on the entire user experience with metrics like number of active users, session intervals, retention rate, abandonment rate, and churn rate.

Acquisition related data points enable you to track the number of downloads and where they’re coming from and further help the banks in understanding which campaigns are working the best for them.

It is of absolute importance to measure the performance of the app. Each crash and every half a second of delay hampers the user experience. These data points help the bank in understanding the reasons behind a high churn and abandonment rate.

#6 Push & In-App Notifications

In-App and push notifications offer multiple benefits to both, the bank and the mobile banking app users. These notifications can be used to inform the customers about any new (relevant) offers and discounts or to relay any other information like change in credit limits or interest rates, or anything else.

This definitely lends a competitive advantage to the banks over others.

#7 Use of AI

Artificial Intelligence or AI refers to the intelligent actions of devices and applications without human intervention. It includes in it, a number of concepts like:

- Machine Learning (ML)

- Machine Analytics

- Natural Language Processing

- Algorithms

- Chatbots, and more

The AI technology as a whole has a huge impact on the mobile banking industry. From taking customer service and user experience several notches up through chatbots, add efficiency, speed, and security.

Let’s take a look at the most important ways in which AI can bring about a change in the way mobile banking and mobile banking apps function.

1) Personalized Customer Service

Machine Learning is one of the most prominent applications of Artificial Intelligence because it lets the bank or the financial institution that owns the app process massive amount of data and come up with insightful conclusions from this information.

Through AI, businesses can study and draw insights about user behavior and figure out the preferences of other users.

AI systems can be trained to achieve better data sets that would learn with each interaction and then use that learning for subsequent interactions.

2) Chatbots

Incorporating chatbots in the mobile banking app actually saves the bank a lot more money as compared to getting human resource. Chatbots are extremely easy to use and can even be used with ease by those customers who aren’t so technically inclined and aware. It has been established through research that customers are looking for quick and personalized interactions and do not prefer email or online communication.

3) Better Financial Planning

As customers go looking for better financial plans for their money, the financial institutions employ quite complex calculations that is based on a number of variables including their earning, contingency, relevant risks, liabilities, monetary inflation, etc.

It is obvious that for carrying out such complicated calculations and for further analytics, it is better to rely on machine intelligence and analytics where the margin of errors is narrower, and more effective than human calculations which may be subject to errors and biases.

4) Intelligent Financial Advisory

Customers come to banking and financial institutions for financial advice when it comes to making decisions regarding their investment, financial planning, and even insurance. The advisory that comes from a machine learning based Artificial Intelligence technology is far more accurate as compared to human resources.

5) Fraud Detection

Artificial Intelligence services can be quite effective when it comes to finding patterns and any fraudulent behavior. These services are specifically designed with an ability to detect frauds or any suspicious activities in real-time and can even predict how the fraudulent behavior is going to progress.

In addition to this, security efforts powered by AI can help the banks add multiple layers of strong security for mobile banking.

6) Fast & Efficient Transaction

In mobile banking apps that have AI features, same transactions take much lesser time and require a lot fewer resources. Mobile apps based on Artificial Intelligence can easily and quickly guide the users to channels or activities that they prefer without wasting any time or resources. This effectively makes the whole transaction a lot faster and efficient.

7) Self-Driving Banks

No one loves going to the banks, standing in endless queues just for a simple withdrawal, deposit, or transfer of money. One of the biggest reasons for mobile banking apps to be conceived, introduced, and for them to become popular.

Using AI in mobile banking apps, it is possible to automate certain transactions. The transaction patterns can be monitored, and the customer be informed in case of any unusual activity in the account.

In case of loss of card, there is no need to make a call, wait on a long call with customer care, or go stand in a queue physically. All it takes is one single ping and the card can be blocked immediately, raising the consumer experience manifold.

8) Risk Management

As the bank is considering whether or not they should approve a loan request, there is a certain risk that they need to consider. There was a time when the banks would perform a manual risk assessment process and estimate the creditworthiness of the borrower by studying the financial history like credit history, transaction history, and an approximate estimation of their income growth. This, however, did not prove as an accurate measure of predicting the future behavior as inconsistencies began emerging more frequently.

Artificial Intelligence when used for the mobile banking apps can analyze real time data on the basis of the most recent transactions, current market conditions, and relevant current events. This can help the banks in being able to identify any potential risks involved in the loans.

It is now possible to analyze massive amounts of data and understand the activities at the micro level by leveraging predictive analysis of Artificial Intelligence.

Conclusion

The way we do things has changed in a big way with the increased use of mobile devices. In recent times there have been revolutionary new developments in the field of mobile devices, including the technologies driving them. Artificial intelligence has been around for a long time, however their use in mobile applications has increased in the recent times.

As discussed in the blog post above, you can see the scope of using artificial intelligence in mobile banking apps and how far ahead it can take you in the fintech space. It naturally heightens the overall user experience but has far and wide applications in the banking area due to the additional security offers. This is especially important due to the sensitive nature of the banking world.

Have you tried creating an app the Appy Pie way? It is great for small budgets and needs no coding! Go ahead and give it a try now!

Related Articles

- NFTs – The Future of Fashion (Podcast 104)

- How To Live Stream Successfully?

- How to Design a Meme in 4 Simple Steps?

- App Store Turns 10 in 2018: A Peek Into The Evolution of Mobile App Development

- How to Make A Shopping App?

- How To: Get Started With CocoaPods

- Must-have App Features for Real Estate App Development

- Benefits and Importance of Non-Fungible Tokens (NFTs)

- FlatMap and CompactMap Explained in Swift

- A Beginner’s Guide to Create a Great Survey [+7 Survey Platforms to Consider]

Most Popular Posts

Photoshop Alternatives: Top 10 Graphic Design Tools in 2024

Photoshop Alternatives: Top 10 Graphic Design Tools in 2024 By Deepak Kumar | July 25, 2024

Canva vs Appy Pie Design – Which is Better?

Canva vs Appy Pie Design – Which is Better? By anupam | July 18, 2024

Canva Alternatives: Top 15 Graphic Design Tools to Replace Canva in 2024

Canva Alternatives: Top 15 Graphic Design Tools to Replace Canva in 2024 By anupam | July 18, 2024

Canva Review: Key Features, Pros, Cons & Pricing

Canva Review: Key Features, Pros, Cons & Pricing By anupam | July 18, 2024

8 Best ManyChat Alternatives in 2024

8 Best ManyChat Alternatives in 2024 By Samarpit Nasa | July 12, 2024