How NFTs Grew by More than 26,000% in 2021 versus 2020?

By Snigdha | Last Updated on April 6th, 2024 6:30 am

Everyone is talking about NFTs today, but what is NFT? NFT’s full form is non-fungible token - a non-interchangeable unit of data stored on a blockchain that can be sold or purchased. An NFT can be any digital file like drawings, music, photos, videos, and more. However, NFT art is currently the flavor of the season for both sellers and buyers or collectors. NFTs are unique, non-transferable digital assets stored in blockchain. When you buy an NFT using a cryptocurrency like Ethereum, you get a certificate of authenticity. This is why they are often used to prove the ownership of digital files. (Statista, 2022)

NFT growth (History)

In 2021 alone, approximately $41 billion worth of crypto was spent on NFT marketplaces. This unexpected ascent of NFTs in 2021 makes us a little forgetful of the tumultuous history of NFTs since the first one. Do you know who created the first NFT? It was Kevin McCoy who created the first NFT - Quantum in 2014. This iconic NFT is a pixelated octagon filled with a variety of shapes that pulse hypnotically. As NFTs became mainstream and ascended exponentially in 2021, we saw it sell for more than $1.4 million in a Sotheby auction. Though we are talking about the big NFT boom in 2021, we cannot ignore the memorable peak in 2017 when NFTs went public. But first, what happened to NFT between 2014 and 2016? These were the years of experimentation and development, especially on the Bitcoin blockchain-based platforms. This was also the time when Ethereum was only beginning its imminent reign on this emerging industry. Initially, NFTs were common in the gaming community, and later, by 2016, the age of memes began. As Rare Pepes NFTs were released on the CounterParty platform, it suddenly transformed into a database of these alternative tokens. This was an entirely unintended outcome! However, seasoned bitcoin users were not happy with the idea of filling up precious block space with tokens that represented ownership. This was when the shift of NFTs to the Ethereum blockchain began.In 2017, NFTs went public.

NFTs find favor with Ethereum. In 2015, as the platform went live, they announced some token standards that would allow developers to create tokens. The blockchains like Ethereum, which support smart contracts, often include token standards to tell people how they can create, issue and deploy new tokens on that specific blockchain. The release of Cryptopunks and CryptoKitties helped shape up the NFT landscape as these tokens today have a historical significance and legacy. Cryptopunks introduced more than 10,000 different characters, and CryptoKitties introduced the concept of gaming and NFTs. CryptoPunks are an NFT collection of 24x24, 8-bit-style pop art pixel portraits. There are 10,000 CryptoPunks, each with a unique personality and a combination of randomly generated features, from traits to accessories. (Statista, 2022) The rage around CryptoKitties actually clogged up the Ethereum blockchain with its extremely high activity levels. It was around 2017-2018 when people witnessed this phenomenon and realized how potent NFTs could be. In 2017, CryptoKitties was the first NFT created on the Ethereum blockchain using the ERC-721 token standard. CryptoKitties sales unexpectedly rose in early September 2021 as NFT trading soared around that time. However, the interest in this NFT was focused around the first 100 CryptoKitties - the "genesis" line. This was because a popular NFT collector tweeted his purchase of a pair of these. (Statista, 2022) The next significant phase was 2018-2020, when NFTs gradually started gaining the public’s attention, primarily due to NFT gaming and metaverse projects. The market cap for NFTs grew nearly ten-fold between 2018 and 2020. In early 2021, an NFT digital artwork raked in $69 million - making it the third-most-expensive art piece ever sold from a living artist. This was also a time when the price of several cryptocurrencies grew exponentially, and interest in crypto and blockchain reached new heights. For example, the price for a single Bitcoin hit an all-time high of $60,000 in March 2021. (Statista, 2021) NFT transactions increased significantly during mid-2021, as several tokens gained popularity. The play-to-earn Vietnamese video game Axie Infinity became the world's most valuable NFT collection in August 2021, before its sales volume declined. (Statista, 2022) The first massive NFT activity was recorded in December 2017 and was connected to the wild rise in the popularity of CryptoKitties and the second moment, in March 2021, was due to the media reporting the largest NFT sales. The third time this happened was when the NFT trading activity more than doubled between July and August 2021. During this period, the number of unique wallets grew by 185,000, bringing the total to 280,000. (Statista, 2022)NFT structure today - Marketplace, ICO, Crypto

The overall NFT market has grown by more than 26,000% in 2021 versus 2020. In the future, the market size is expected to grow 33% year on year and reach approximately $80 billion in net sales volume by 2025. This number will grow to about $350 billion by 2030. (Tokenized, 2022) Irrespective of the nature of technology, change is a healthy constant. Now that we are in 2022, NFT as an industry has become a lot more structured. Today, there are established marketplaces like OpenSea, Rarible, etc., for listing, trading, and buying NFTs. 2017 also saw the release of ICOs, and people made a beeline for it. In 2021, OpenSea’s all-time trading volume was three times higher than Axie Infinity. However, not all marketplaces are the same. For example, Axie Infinity, NBA Top Shot, and Decentraland are gaming NFTs that bank upon collectibles or metaverses. OpenSea and Sushiswap work like decentralized exchanges where anyone can go and buy or sell NFTs or cryptos. Cryptopunks and Solanart cater to the most popular NFT category - crypto art. (Statista, 2022) OpenSea overtook UniSwap by January 2022 in terms of usage on the Ethereum blockchain. Why is this significant, you ask? UniSwap is the world's largest decentralized exchange (DEX) on Ethereum, whereas OpenSea focuses on the sale and purchase of NFTs. It means that people on Ethereum are more interested in trading NFTs as compared to cryptocurrencies. (Statista, 2022) As you can see in the graph charted by Statista above, the funding achieved through blockchain ICOs reached its peak in Q1 2018 at $6.88 billion. (Statista, 2022)

The ICO categories vary from year to year, but investment in blockchain infrastructure is a constant. Between 2016 and 2019, 1676 token sales were completed, amounting to a total of about $ 29.2 billion.

Let’s talk about DeFi protocols for a bit here. DeFi protocols increasingly generate more money. In fact, the video game Axie Infinity generated a revenue of more than $300 million in August 2021. The increase is of such significant proportions that the protocol revenue for Opensea was ten times more in August 2021 than the previous month. So what is this protocol revenue we are talking about? Protocol revenue is the fees taken directly by the protocol and the token owners, which is different from the supply-side revenue, which is the revenue given to those who use the protocol. (Statista, 2022)

As you can see in the graph charted by Statista above, the funding achieved through blockchain ICOs reached its peak in Q1 2018 at $6.88 billion. (Statista, 2022)

The ICO categories vary from year to year, but investment in blockchain infrastructure is a constant. Between 2016 and 2019, 1676 token sales were completed, amounting to a total of about $ 29.2 billion.

Let’s talk about DeFi protocols for a bit here. DeFi protocols increasingly generate more money. In fact, the video game Axie Infinity generated a revenue of more than $300 million in August 2021. The increase is of such significant proportions that the protocol revenue for Opensea was ten times more in August 2021 than the previous month. So what is this protocol revenue we are talking about? Protocol revenue is the fees taken directly by the protocol and the token owners, which is different from the supply-side revenue, which is the revenue given to those who use the protocol. (Statista, 2022)Who is buying NFTs?

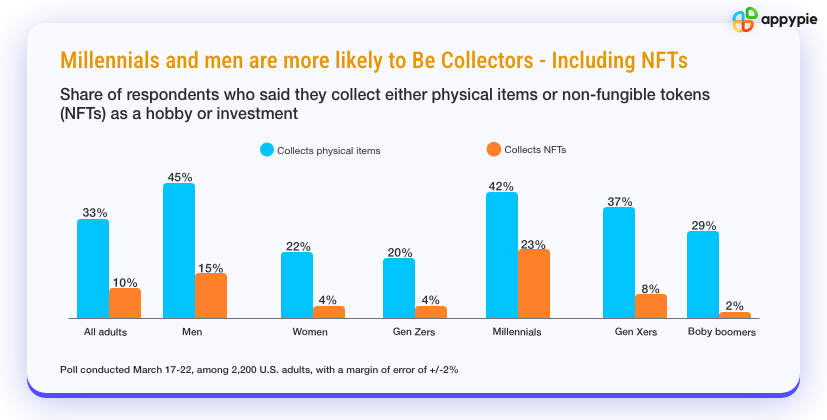

We have talked about creating, listing, trading, and selling NFTs. Now, let’s pay attention to those who buy NFTs. Let us begin with the countries where NFT is most popular. Would you believe that the top five countries with the biggest NFT adoption are in Asia! Curious about the names of these countries? Leave a comment below, and I will let you know! As per several global Google Surveys held in September 2021, NFTs were especially popular in Southeast Asia and Latin America. However, it is suspected that the high percentage observed in some countries may be caused by online games where people can earn money by playing the game. (Statista, 2022) Millennials are three times more likely to buy NFTs as compared to Gen Z. In fact, 23% of the millennials in the US collect NFTs. Another interesting factoid is that men are three times more likely to collect NFTs as compared to women. Only about one in 10 Americans invested in NFTs in early 2021. Information about how often people from around the world were searching for the keyword "NFT" was compiled through Google Trends, and it was discovered that consumers from Asia and Oceania were more interested in NFTs compared to consumers from Europe and Latin America. (Statista, 2022)

Information about how often people from around the world were searching for the keyword "NFT" was compiled through Google Trends, and it was discovered that consumers from Asia and Oceania were more interested in NFTs compared to consumers from Europe and Latin America. (Statista, 2022)

How much is the NFT market worth in 2022?

The global NFT market is expected to grow from $14.02 billion in 2021 to $21.33 billion in 2022. The market exhibits an impressive CAGR of 52.1%.Top-grossing NFTs

Beeple's ‘Everydays: the First 5000 Days’ is the most expensive NFT sold to a single owner. (Statista, 2021) “Don’t buy it because it’s an NFT,” said Evan Cohen, co-founder of Vincent. “Buy it because you like the art or buy it because you think the collectible is cool or the community is cool. You want to participate for the asset, not the underlying technology that powers this.” That’s excellent advice! But just for fun, let’s look at the 100 most expensive NFTs ever sold.- Pak’s ‘The Merge’ — $91.8m

- Everydays: the First 5000 Days — $69.3m (39,134 ETH)

- Clock — $52.7m (16,953 ETH)

- Beeple’s HUMAN ONE — $28.98m

- CryptoPunk #5822 — $23.7m (8,000 ETH)

- CryptoPunk #7523 — $11.75m (4,757 ETH)

- CryptoPunk #4156 — 2,500 ETH

- CryptoPunk #7804 — 4,200 ETH

- CryptoPunk #3100 — 4,200 ETH

- Beeple’s Crossroad — 4,475 ETH

- OCEAN FRONT — 3,766 ETH

- Source Code for the WWW - 2,572 ETH

- Stay Free - 2,224 ETH

- Save Thousands of Lives - 1,337 ETH

- Doge - 1,696.9 ETH

- Mona Money Matrix - 1,315 ETH

- The first tweet - 1,630.6 ETH

- Meebit #10761 - 700 ETH

- Meebit #17522 - 1,000 ETH

- Dreaming at Dusk - 500 ETH

- CryptoPunk #3011 - 667 ETH

- CryptoPunk #6965 - 800 ETH

- Death Dip - 1,000 ETH

- Genesis Estate - $1.5m

- CryptoPunk #2066 - $1.47m

- Autoglyph #17 - $1.44m

- Gunky’s Uprising - $1.3m

- Destination Hexagon - $1.23m

- CryptoPunk #2890 - $1.2m

- CryptoPunk #6297 - $1.17m

- CryptoPunk #6487 - $1.07m

- Forever Rose - $1m

- CryptoPunk #3393 - $954.65k

- CryptoPunk #2140 - $804k

- Citadel of the Sun - $800k

- Everydays – Raw #39/100 - $708.02k

- Metarift - 489 ETH

- Hairy - 485 ETH

- CryptoPunk #2484 - 480 ETH

- Reflection - 475 ETH

- CryptoPunk #2306 - 461 ETH

- CryptoPunk #1886 - 450 ETH

- Finite - 444 ETH

- Psy Art #94 - 432 ETH

- Meebit #8598 - 420 ETH

- Pepe the Frog NFT Genesis - 420 ETH

- Hashmask #9939 - 420 ETH

- CryptoPunk #1119 - 400 ETH

- CryptoPunk #1190 - 400 ETH

- Meebit #2948 - 400 ETH

- Meebit #776 - 390 ETH

- Decentraland #4247 - 389 ETH

- Wave 2 / Summer Jam - 382 ETH

- CryptoPunk #6704 - 380 ETH

- CryptoPunk #3609 - 375 ETH

- Axie Infinity #2655 - 369 ETH

- CryptoPunk #1839 - 360 ETH

- Autoglyph #287 - 355 ETH

- The New York Times x NFT - 350 ETH

- CryptoPunk #5234 - 350 ETH

- Golden Bull - 337 ETH

- Bull Run #6/271 - 334 ETH

- Politics is Bullshit #2/100 - 333 ETH

- GOAT - 333 ETH

- Bull Run #120/271 - 333 ETH

- CryptoPunk #2424 - 325 ETH

- Everlasting Beauty - 319 ETH

- x*y=k - 310 ETH

- CryptoPunk #2964 - 305 ETH

- Meebit #19775 - 300 ETH

- Nyan Cat - 300 ETH

- EulerBeats Genesis LP 01 - 300 ETH

- Hashmask #6718 - 300 ETH

- (1-of-1) GRONK Career Highlight Card - 299 ETH

- Meebit #16647 - 299 ETH

- Hashmask #12247 - 294 ETH

- Mars House - 288 ETH

- 1-of-1 Warriors 6x World Champion Ring NFT & Physical Ring - 285 ETH

- Politics is Bullshit #83/100 - 279 ETH

- Premium Estate - 277 ETH

- CryptoPunk #2681 - 277 ETH

- Meebit #19480 - 275 ETH

- Yuut Park West - 267 ETH

- UNIQUE 24×24 Estate - approx. 250 ETH

- Extra Large #2646 (XL) parcel in Somnium Space - 250 ETH

- Hope - 250 ETH

- Meebit #19729 - 245 ETH

- Enduring Shield #219569265 - approx 240 ETH

- CryptoPunk #3106 - 240 ETH

- Meebit #11796 - 235 ETH

- Original Banksy Morons - 229 ETH

- Meebit #16920 - 201 ETH

- Meebit #564 - 200 ETH

- CryptoPunk #824 - 200 ETH

- #11. Money Factory - 200 ETH

- CryptoPunk #8870 - 200 ETH

- Overly Attached Girlfriend - 200 ETH

- Autoglyph #313 - 193 ETH

- Jangale Asfalt - 190 ETH

- Meebit #15168 - 185 ETH

What is the most promising NFT?

Though there are several different reasons why the US population invests in NFTs, one common reason across generations and genders is - the return on investments. (Statista, 2021) The concept of investing in NFTs is relatively new. Hence, the average Joe may struggle with choosing the right NFTs for investment. Here is a curated list of the most promising NFTs just for you!- Flyfish ClubThe concept here is truly unique as Flyfish Club is the world’s first NFT members-only private dining club. According to the Flyfish club site - "As an NFT, the membership becomes an asset to the token holder, which can later be sold, transferred or leased to others on the secondary market."

- Autograph.ioMore of a marketplace than an NFT, Autograph.io offers the best sports NFTs for fans! It is a kind of an NFT Agency that lets celebrities, sportspeople, and other big names launch their own NFT collections.

- Mutant Ape Yacht ClubA new project from the makers of Bored Ape Yacht Club, Mutant Ape Yacht Club is a slightly more affordable version of the popular predecessor. BAYC has introduced a new NFT ‘serum’ which can be applied to the original Bored Apes and convert them into Mutant Apes. BAYC sells millions worth of NFTs minted on the Ethereum blockchain each day. In September 2021, auction house Sotheby's sold a collection of 101 BAYC NFTs for around $24.4 million - making it one of the biggest NFT sales up to that point. (Statista, 2022)

- DippiesThe co-founders Salman Shawaf and Johnathan Taylor are using Dippies to bring in a digital hippy movement by introducing the 60s psychedelic aesthetics, flowers, and a whole lot of color to the Metaverse. Proof of Beauty It’s an experimental NFT studio that lets users turn personal and historic blockchain transactions into artworks. The reason why it has gained such popularity is that it turns nostalgia into art. Property’s Virtual Reality This NFT collection is based on two different but equally exciting gamification concepts - a collecting game and a multi-metaverse experience. The aim of this NFT is to bring the Metaverse to life with NFTs.

- The Galaktic Gang CollectionThese NFTs are more than mere artwork. It is a community. Every new member gets a set of unique attributes through a generative randomizer, and each member also gets exclusive rights to the community.

- AzukiThis NFT collection consists of 10,000 avatars, and the members get access to ‘The Garden,’ where they can discuss the new decentralized future. The Garden can be thought of as the proverbial intellectual coffee shop in the digital realm.

- Monkey League (MonkeyBall)“Monkey League is a next-gen esports game on the metaverse that enables players to Create, Play, Compete, and Earn,” it says on their site. It is a turn-based Play-to-Earn football game where each Monkey player has a unique ‘DNA’ that makes up its appearance, trainability, and special elements.

- Axie InfinityA game styled like the wildly popular Pokemon game, it lets you use Axies’ unique abilities to win battles against other players. This play-to-earn game lets the players earn tokens - Axie Infinity Shards (AXS) and Smooth Love Potions (SLP) - by playing the game. These tokens can be spent within the game, but you can also be traded on DEXs for real-world money. (Statista, 2022)

Average NFTprice + cost of minting and mining

Yes, we all love to talk about the NFTs that earned millions of dollars as they went on the market, but let’s help you do a reality check. According to recent research conducted by the artist Kimberly Parker and an anonymous data scientist, 53.6% of NFTs sold on OpenSea in March 2021 were sold for less than $200. Now, if you thought that was ridiculous, here’s another doozy! You may have to pay about half of that $200 in minting and selling your NFT! The average cost hovers between $70 and $120. However, people have been known to spend thousands too! As the underlying technology is blockchain, creating NFTs can be expensive. This is where no-code platforms have found their opportunity. The transactions started increasing in numbers and complexity post-2020, and between September 2020 and March 2021, the Ethereum network fee grew by more than 300%. (Statista, 2022) Appy Pie has a singular mission to make cutting-edge technology affordable and accessible to businesses of all sizes and scales. Its no-code NFT generator lets you create NFTs in minutes without the need for any tech intervention.What are people doing with their NFT purchases?

As per a recent research by the Financial Times and Chainalysis, there are about 360,000 NFT owners worth about $2.7 million. However, around 9% of them account for approximately 80% of the market value. (Financial Times) The majority of the NFT investors who are new to the field are still trying to figure out how to use their NFT purchases in the best possible manner. Hence there is a kind of hesitation and lack of understanding of the right time to sell. This is why most of these investors are yet to recoup their investment in NFTs. The uncertainty around NFTs has encouraged most investors to buy collectibles that they feel connected to.Do NFTs go up in value?

There is a certain amount of speculation and the air of rarity around NFTs, which indicates that NFTs have the potential to increase in their value. This is why we often see the resellers making a handsome profit by selling their NFTs at a much higher value than the cost price. However, this increase in value is subjective and depends on the buyer's perception. This is pretty similar to how the physical art world works, where the value of an artwork depends on how valuable the buyer perceives it to be. The floor price of NFTs reached its peak in September 2021 and was ten times higher than the figure in early June 2021, indicating that NFT trading became extremely popular during that time. (Statista, 2022)Types of most popular NFTs

NFT projects in art and gaming were worth several millions of U.S. dollars in 2020 already but were still much smaller than figures in 2021. (Statista, 2022) In 2020, the gaming segment accounted for roughly 23 percent of the total sales revenue in the NFT market. In the same year, the art segment sold only 64.5K units, and it reported slightly higher sales revenues than the gaming sector. (Statista, 2021) Splinterland experienced a surge of popularity in September 2021 as it saw an increase in sales volume. However, it is based on the basic play-to-earn model, where players earn cryptocurrency by playing the game. The game is different from others in one critical manner - the game does not run on the Ethereum blockchain but Hive. (Statista, 2022)- ArtworksOne of the most popular categories, NFT artworks, includes digital artworks with a public certificate of authenticity and ownership issued by the digital ledger (blockchain) where they are stored. The most expensive NFT sold is the artwork called 'The Merge' by artist Pak for a whopping $91.8 million in December 2021. According to ArtTactic's NFT Art Market Report, Nifty Gateway - an online NFT platform, launched 6,623 new NFT Artworks, representing the digital artworks of 418 artists between May 2020 and September 2021, and earned around $408.8 million in both primary and secondary market. (Statista, 2022) The NFT art market is susceptible to fluctuations. On April 15, 2021, the total number of NFT art sales in a period of 30 days was 28.4 thousand. Trading of art NFTs reached a high of 109.1 thousand in the middle of August 2021 for the same period. However, on April 15, 2022, this number had fallen to 22.4 thousand. (Statista, 2022)

- CollectiblesNFT collectibles are the digital version of physical collectibles like mint-condition action figures or Pokemon cards. The first major NFT collectibles were Curio Cards, following which a series of collectibles like Bored Ape Yacht Club, Cryptopunks, Cat Colony, Meebits, and more. 2021 was a good year for the NFT collectible NBA Top Shot as both critical numbers - transactions and unique buyers- were much higher in 2021 than in 2020. The number of unique buyers soared high, particularly in March 2021. However, the translation volume stayed the same. Though there is no hard evidence connecting the two, it has been observed that this was around the time that the traditional All-Star Game occurs. (Statista, 2022)

- Sports memorabiliaOne of the most coveted NFT categories is - Sports Memorabilia. The most noticeable NFT in this category is the NBA Top Shot. Generally, this type of NFT includes a video clip of a memorable sports moment. For example, The LeBron James Dunk, Throwdowns (series) sold for more than $380,000. It is one of the most expensive Sports Memorabilia NFTs ever. LeBron James’ NBA Top Shot moments were traded for much more money than many upcoming NBA stars combined. Dallas Mavericks' Luka Doncic and Zion Williamson from New Orleans Pelicans appeared on the second and third positions. (Statista, 2022) According to a survey conducted in June 2021 among sports fans in the U.S., most started investing in Sports Memorabilia NFTs like NBA Top Shot because they saw someone close to them do it. (Statista, 2022) Some soccer fan clubs offer fan tokens, too, as sports memorabilia. Paris Saint-Germain's market cap was over $20 million higher than FC Barcelona's. Catalan club fan tokens gained popularity in April 2021 after being listed on the crypto trading platform Binance. The European eSports organization OG Esports brought in about $987 thousand through three NFT drops released in one year. On July 6, 2021, they sold ten digital artworks with 3,336 NFTs for about $511 thousand, making it the most expensive NFT drop in the eSports market. (Statista, 2022)

- Video game assetsTypically, NFT video games involve players trying to win levels and rewards like cryptocurrency, digital assets, or other NFTs. The first video game asset NFT was Axie Infinity, and following its success, multiple such games emerged, including Cryptokitties, God Unchained, Sorare, and more. Another NFT game - Alien Worlds, lets players compete on the Ethereum, WAX, and BSC blockchains while exploring seven different planets. The goal is to earn their in-game cryptocurrency - Trillium (TLM), which can be traded for real money. Additionally, Trillium lends control of certain DAOs which means with more tokens in your possession comes more voting power. This is one of the key features of the game. (Statista, 2022)

- Virtual landThis virtual land may include land in a video game or in the metaverse. It may seem a little vague but owning a piece of virtual land gives you the ability to place ads and earn revenue. Here is an example of an overlap between gaming and virtual land NFTs. Decentraland is a 3D virtual reality platform built on the Ethereum blockchain, a combination of a marketplace, an online video game, and cryptocurrencies. Players can create and own parts of the game real estate called LAND, which can be bought or sold using MANA, the game’s cryptocurrency. Ownership of LAND gives players a say on what will happen on their plots.

- MemesWhat started as fun turned into a valuable digital asset with the emergence of NFTs. The original Doge meme sold for $4 million in June 2021, and the meme for disaster girl sold for over $500,000.

- Domain namesIn this context, domain names are crypto domains minted on a blockchain like Ethereum. Of the 500+ extensions available, .eth is the most coveted. Unlike non-NFT domain names, these can be linked to crypto-wallets. However, currently, most browsers do not support crypto domains which is quite a roadblock.

- MusicRelatively a new concept, musicians can pre-release their albums on NFT marketplaces, and buyers can buy a piece of the album. The concept is much like buying shares, where the buyers receive a part of the profit earned by the album when it is later released through traditional channels.

- TicketingConcert or program organizers are now minting the tickets for the events on blockchains and are either auctioning them off or selling them for a fixed price. These NFT tickets can be stored by the owners as memorabilia or later auctioned as a collectible.

- Real-world assetsNFTs are not limited just to the digital world. They have a cross-over in the real world as well. A Real World asset NFT or rwANFt represents virtual ownership of a physical asset. An rwANFt adds an additional layer of security by reducing the chances of forgery and adds transparency with a digital ledger.

- NFT fashionVirtual fashion includes the clothes and accessories designed for digital avatars or characters in video games. Luxury designers like Gucci, RTFKT, Louis Vuitton, Hermes, and Burberry have already taken the plunge with gaming, wearables, and more.

- IdentityThe inherent traits of an NFT, like non-fungibility and transparency, make it an excellent technology for providing identification certificates to individuals.

Environmental impact

There has been a fair amount of concern regarding the environmental impact of NFTs. At the moment, Ethereum consumes 44.94 terawatt-hours of electricity, a number that equals the annual power consumption of countries like Qatar and Hungary. (CBS News, 2021) It is concerning to know that the carbon footprint of an average NFT equals the carbon footprint created by a month’s electricity usage of an EU citizen. So, what is the future of this alarming impact? Naturally, there has been some serious research in this field, and there is hope at the end of what seems to be a very dark tunnel. If the current proof-of-work model of Ethereum is turned into a proof-of-stake model (Ethereum 2.0), the energy consumption of its blockchain will reduce by 99.95%, and it may happen as early as 2022. Once this switch is made, the carbon footprint created by an average NFT will come down to 2.11 kg of CO2 compared to 48 kg of CO2. This means that the carbon footprint of an average NFT transaction would be the same as physically mailing the art piece across the country! Have you ever thought about creating an NFT? What type of NFT would you create? Let us know in the comments section. I’m curious!Related Articles

- 11 Best Gorgias Alternatives in 2023

- Supercharge Your Workflow with ClickUp Integrations

- Best Video Editing Tools for Professionals and Amateurs in 2024

- Lead Management: Definition, Benefits, Best Practices & More

- Reasons Why Mobile Apps Fail & How To Avoid Them

- Emergence of AI-Design Tools: Transforming Creative Workflows

- AT&T Logo History: Journey From Bell to Globe

- How To Build a Profitable App with a Pro Upgrade

- Color Theory Explained: Why Indigo is More Than Just Blue

- 20 Benefits of Chatbots: Revolutionize Your Customer Interaction

Most Popular Posts

- The Most Inspiring Architecture Websites for Designers- 2024’s Guide

- Top 10 WordPress Integrations to Increase Productivity

- How to Start Digital Marketing with Google Ads

- 15 Iconic 90s Websites Design That Defined an Era of Internet Design

- How to Make a Flowchart using AI: Tips to Create a Better Flowchart