What Is A Sales Invoice? Everything You Need to Know

Are you setting up a new business?

Have you just received your first order and need to issue the first sales invoice?

Do you have no idea about what your invoice must include?

Are customers frequently rejecting your invoices because of errors and missing details?

These are telltale signs that you’re making amateur invoicing errors. A rejected invoice delays your payment cycle, brings down the morale of the sales team, creates cash flow problems, and can even infuriate your buyers.

It is essential to understand the nitty-gritty involved in creating a sales invoice because this document deserves more attention than it gets.

What Is A Sales Invoice?

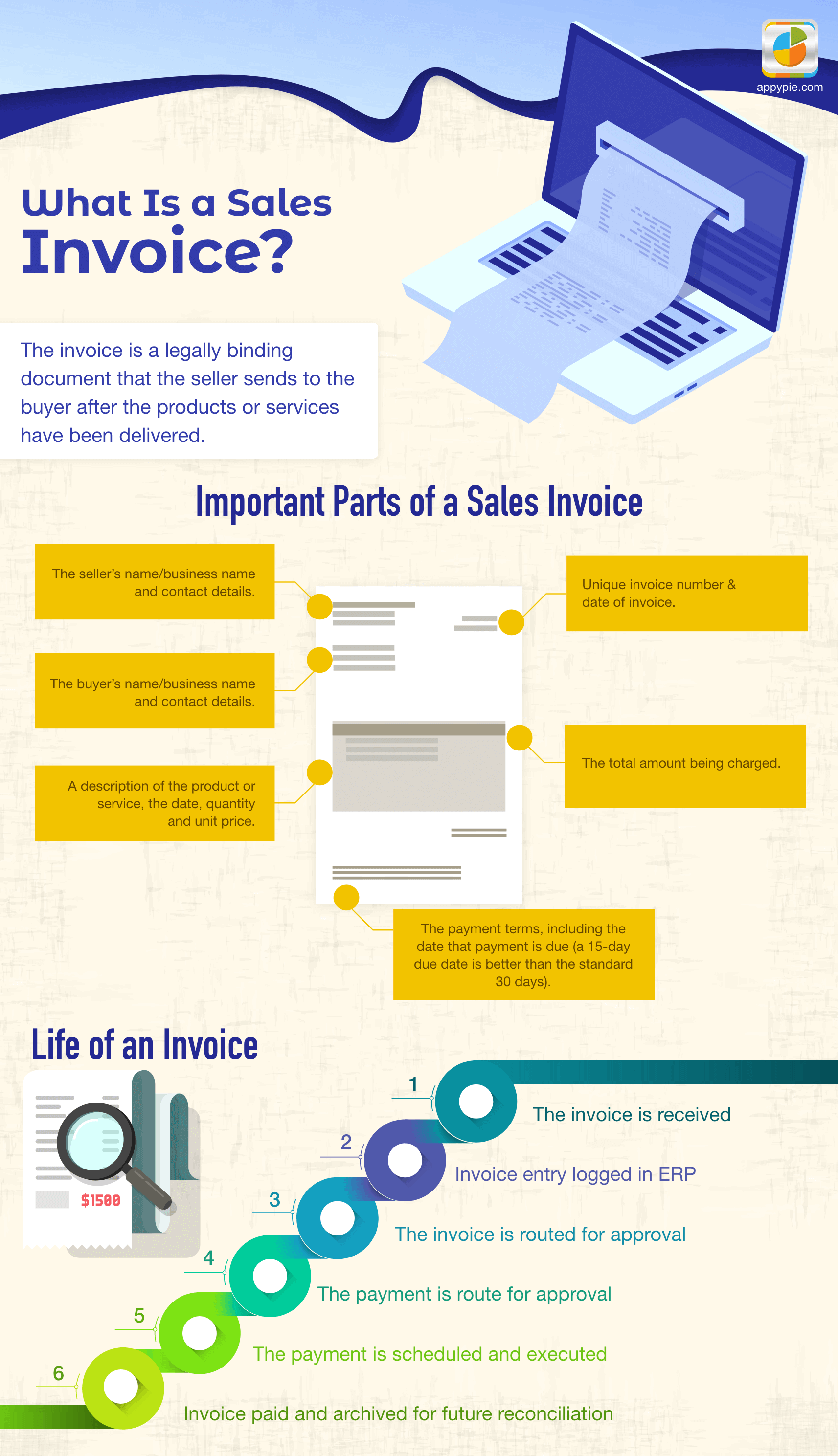

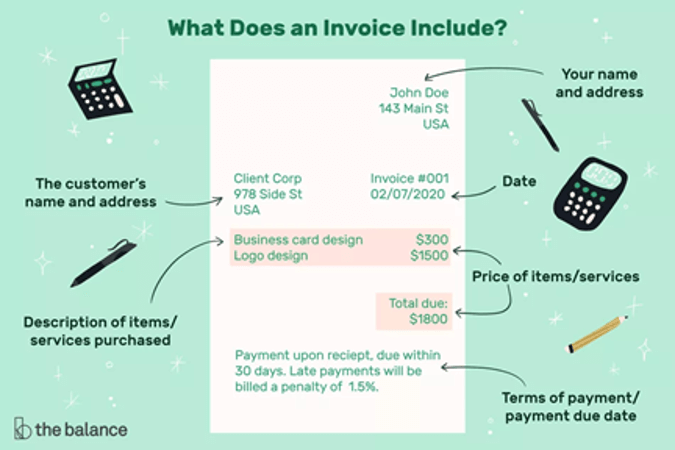

In simple words, a sales invoice is a request for payment. It is a financial document that records a business transaction, the monetary aspects of the exchange, the details of the two (or more) parties involved in the transaction, and the terms of payment. By issuing an invoice, a company establishes a legally binding contract between them and the customer. An invoice verifies that the seller has fulfilled (or assumed legally binding responsibility of) their part of selling and delivery of the product, and that the buyer now needs to pay and fulfill the contract. Sales invoice provide legal protection to both the company and customers and ensure that businesses get paid, while buyers get a record of what they’re paying for, and how much they’re paying. Here’s a visual representation. Image source: www.thebalancesmb.comAn invoice, in many cases, also outlines details regarding the payment terms such as:

Image source: www.thebalancesmb.comAn invoice, in many cases, also outlines details regarding the payment terms such as:Any prepayment that may have been done

The last date of the payment

Prompt payment discounts, if any

Product type

Discounts (if any)

Warranty and guarantee of the product

Don’t Confuse Between Sales Order And Sales Invoice

The critical difference between a sales order and an invoice is that – a sales order is an intent to exchange a product/service in exchange for money. It’s a firm commitment:From the buyer, of his/her intention to purchase

From the seller, of his/her capacity to fulfill the order

Baker enters a sales order to make the sale legally binding.

Baker prepares the cake and delivers it, along with the invoice.

The invoice, then, is proof of the transfer of product/service (cake/delivery) to the customer in exchange for the amount mentioned on the invoice.

Different Regions, Different Invoicing Rules

Sales invoicing could seem to be a simple task in your home country because you are well versed with the dos and don’ts. However, when your business goes global, you will have to take care to learn the rules of the game to create professional invoices. This is because different countries have different sales invoicing requirements.Tax codes

Sales invoices in the USA include sales tax, while in Canada and Australia, you will need to apply Goods and Service Tax (GST) depending on the amount. If your buyers are in the UK, then the sales invoice will include a VAT. Similarly, each country has its particular norms related to declarations of tax break up of the invoice amounts, with accurate tax descriptions.Declarations

You may be required to make declarations related to:Country of origin of the product

Handing instructions for hazardous goods

Customs declaration and other border-related documentation

What To Include In A Sales Invoice?

Irrespective of the region, all invoices must include:Details of the seller such as name, contact information, address, email id, phone number, and the logo

The words “Sales Invoice” prominently typed on it

A unique sales invoice number and accurate date, to help with record-keeping

Contact information and the name of the buyer

A detailed description of the product/services being sold along with the quantities, unit prices, and discounts (if any)

The total amount charged inclusive of the taxes

The payment schedule

Tracking An Invoice – Why Is It Important?

You’ve made a sale, raised an invoice, delivered the product, now what? You need to track the sales invoice to ensure you also receive the payment against it. Tracking can be a difficult task because as your business grows, you will have to deal with hundreds of sales invoices with different dates. Automating your invoicing process also involves the creation of a robust reporting mechanism. This helps you track each invoice, further assisting you in planning your follow up communications, and giving you a better idea of near-term cash flows.Create Clear Payment Terms To Avoid Confusion

It is imperative to create clear policies to have a seamless buying and selling process. A sales invoice is the key to it. Unambiguous terms and conditions will clarify expectations and the rules of engaging in business with you. The terms must include:Prepayment options and the percentage

Payment timelines

Due date and late fee charges

Modes of payment accepted by your business

You Can Automate The Invoicing Process

Putting together financial documents can be a tedious task. Even if you are referring to a Zintego Invoice Template, you will need to input all the invoicing data manually, which can be quite a strenuous activity. Also, when you are manually recording data, you will need a good system to remember the unique sales invoice number that should go on the next document. The trick here is to use technology for the sales invoicing process to help you save yourself a lot of time and energy. Invoice processing can be automated by implementing a software solution. The most obvious advantages include the reduction of costs and faster processing time. With automation software, errors will be minimized. When you use a cloud-based invoicing solution, you can access and create your invoices from anywhere in the world, all with minimal manual intervention. Cloud-based sales invoicing software also allows you to send invoices within minutes as compared to manually creating and sending invoices, which take around 30 minutes to prepare. Trying out Appy Pie Connect can help you automate your invoicing process like a pro!Wrapping up

A sales invoice is a legal document. It protects your business against errors and risks. Invoices play an important role in the growth of your business. Accurate invoicing is the pillar of your payments collection process. Reliable invoicing practices ensure your accounting team remains in control of pending payments. Moreover, a professional invoice creates the right impression on the customer. Therefore, it is important to implement a seamless invoicing system for seamless business.Related Articles

- Why Should You Choose Appy Pie’s White Label Reseller Program for iPaaS?

- Mailchimp vs. Constant Contact – A Complete Comparison

- 5 Top File Sharing Apps for Businesses: Streamlining Collaboration and Data Management

- How to Design a Compelling Character- The Ultimate Guide to Character Design

- Common App Design Mistakes to Avoid

- 21 Best Workflow Management Software & Tools in 2024

- A Brief Guide To Video Marketing for Businesses in 2021

- The Ultimate Guide to IT Ticketing Systems in 2023

- The Power of Customer Focus: Enhancing Customer Service

- How to Design a Meme in 4 Simple Steps?