How Financial Process Automation Can Help Your Business?

By Abhinav Girdhar | Last Updated on December 13th, 2023 10:16 am | 5-min read

The greatest downside to accounting and financial process management is the fact that there is a lot of scope for human error. The reason for a lot of human error can be narrowed down to overwhelming and stressful workloads. Keeping up with day-to-day tasks and painstakingly doing them right can leave even the best of professionals exhausted. It is normal for accountants and other financial professionals to work for 12-13 hours a day. Nobody should be required to work that long.*

Table of Contents

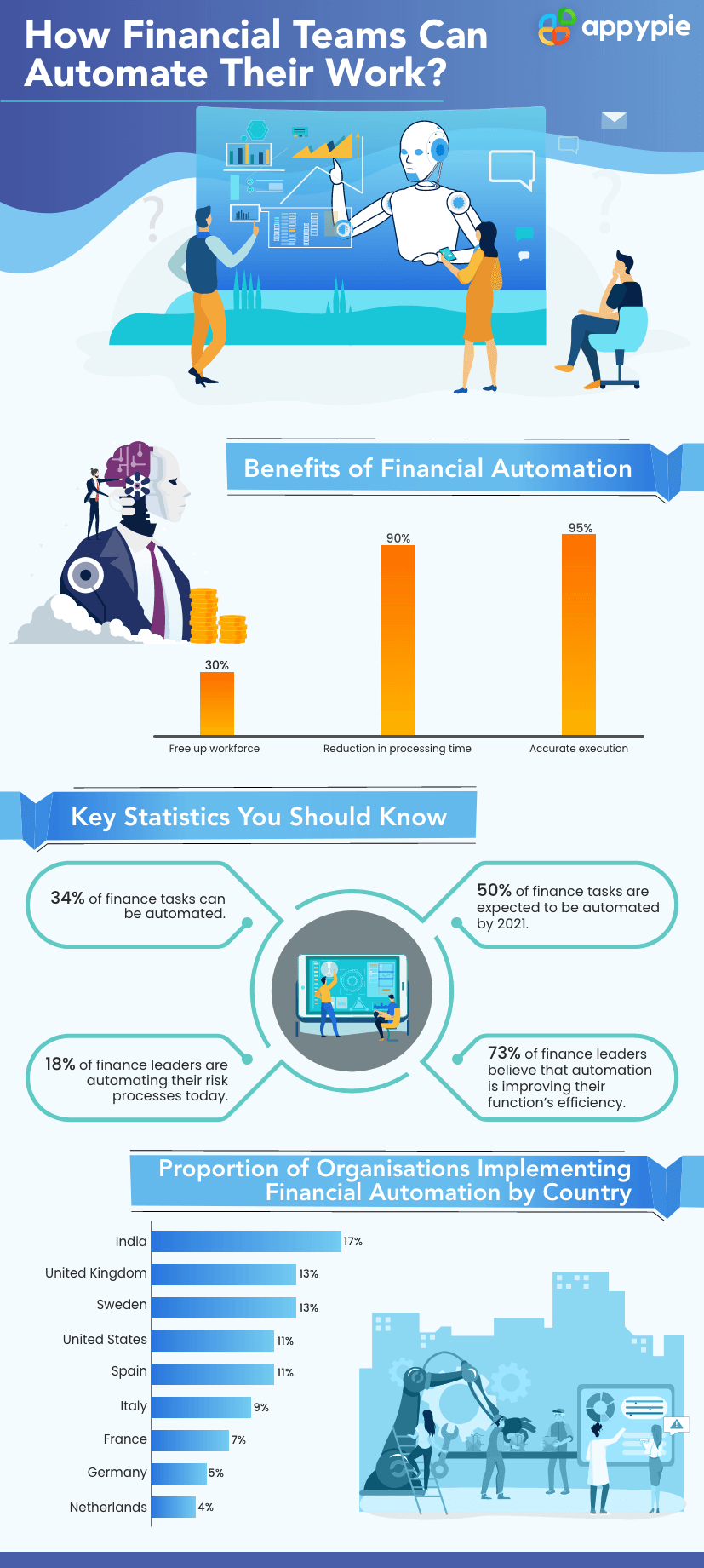

This brings us to an important question. Why is there such a high chance of human error? Working in finance requires a lot of know-how, mental ability, and pressure-handling capability. Even if you are committed to what you’re doing there is a very high chance of making mistakes. Bookkeeping and other financial processes today require complicated math, an understanding of financial standards, floating exchange rates, hundreds of spreadsheets, and the ability to make strategic executive decisions almost instantaneously. The easiest way to minimize errors made in various financial processes is by automation. In fact, financial process automation is not a new concept. It’s already in effect in many places across the globe. Here are a few statistics related to financial process automation that you should know.

What is Financial Automation?

Let’s begin with the basics, shall we? What is financial automation? Financial automation is the use of software to automate simple but key financial processes such as bookkeeping, journal updates, graphical data, preparation of financial statements, etc. All of said work must be done with minimal human involvement and is completely automated and standardized. There are various effects financial automation can have on your processes:- It can automatically populate standard information from a common database.

- The results of financial processes can be automatically distributed and sent to relevant people that will make strategic decisions.

- Data transfers, data entry, etc can be taken care of on their own leaving more time for the more complex problems.

- Tasks that actually require human intuition, decision making ability, and talent can be focused on more.

- Accuracy improvements are certain. Most organizations that have automated financial processes have consistently reported better accuracy and sharper decision-making improving overall revenue for businesses.

How Financial Automation Helps Your Business

There are various benefits that financial automation can bring for your business. Here are some of those benefits:- Better Data Integrity

- Accuracy and Efficiency

- Faster Processing and Approvals

- Better Visibility

- Flexibility

Even the best finance teams can fall short when it comes to data integrity. For a financial team, data integrity is everything. Whatever decision they will take, data integrity will play an important role. With process automation, data integrity can be ensured to the highest degree. An automated process with the correct workflow will never be wrong. This ensures that whatever decision your financial team takes, it will be with extremely accurate data.

Some financial processes require professionals to take data from common databases. Moving from manual work to automation can smoothen financial processes to a surprising degree of efficiency.

Automating approvals can save a lot of time every week. Research shows that nearly 8 hours every week can be spent on approvals of reimbursement claims, budget approvals, etc. Automating this will not only save time but also take away the responsibility of regularly checking bulky email threads.

Automating financial workflows will require you to integrate each part of your financial systems through a workflow automation software. Doing this will give you a complete understanding of your financials. It can also be used to create specialized workflows for analysis and give you a better perspective of your business. From fluctuating financials to unnecessary overhead, you will have a better grasp of how your business is actually doing.

The best part of automating your financial processes is the flexibility it provides you. Workflows are easier to manage and depending on the automation software you go for, it provides you a plethora of possible integrations to make life easier. For example, our workflow automation software Appy Pie Connect provides over 150 integrations for financial process automation.How to Automate Your Financial Processes

There are a lot of financial processes that can be automated. However, before you automate your financial processes there are a few things you need to take care of.- Standardization

- Creating Workflows

- Integrations

Whatever financial process you want to automate, you must first devise a visual representation of it. Create a raw workflow of your financial process. Jot down the various parts of your workflow on a whiteboard. You can then see what changes you need to make and where you need to make them.

Once you have the future process of your automation down, you must begin creating your new workflow. To do that, you can either hire someone to develop a business-specific software or just make it simple and use an existing workflow automation tool. We recommend Appy Pie Connect. It’s simply one of the best out there and is extremely easy to use.

With Connect, you can integrate various software involved in your processes under a single interface. In addition, Connect provides you a visual interface for your workflow making it easier for you to know which tasks are being completed and how they are being managed.

Apart from simply automating workflows, Connect also allows you to add your team members for parts of your workflow that require human intervention. It does double duty by automating both your workflows and your work increasing your work efficiency. Connect Your Workflow Today!

Once you do create a workflow, the next part of the process is to integrate your workflow with the various software you use. Connect currently provides over 150+ app integrations for your workflows. Check them out and choose what works best for you.Conclusion

Automation is the word of the day. The R2R or record to report model is no longer efficient in the current fast-paced world. With traditional accounting processes, hundreds and thousands of transactions require dedicated employees working overworked shifts. In addition, most of this work is done on the month end with extremely brutal deadlines. This is why manual error is still such a huge problem in accounting. Moving to automation is an excellent alternative. One of the problems with adopting automation is the fact that people think that it is a threat to jobs. Financial automation processes simply reduce the workload. You will still need dedicated employees for the more important things.Do leave us your thoughts in the comments!Related Articles

- 21 Best Gym Management Software in 2024

- Introduction to Conversational AI

- How To Build A Consultant Business Plan

- Key Web Design Principles to Follow in 2022-23

- GoMAvatar: Efficient Animatable Human Modeling from Monocular Video Using Gaussians-on-Mesh

- 15 Pro Tips to Master Calendar Management for Optimizing Your Time

- 35 Call Center Metrics to Improve the Customer Experience

- How to get your app published to the iOS store?

- How to Build an Azure Chatbot

- Maximizing Profits with Ray Tracing in PC Gaming